调整后的里程率为 分配给所有税务机关

by the assessor, and by law must be adopted by their

董事会. However, each taxing body 董事会 can then vote

to “滚” 这些调整后的里程率.

这是增税.

The purpose of reassessment is to ensure the uniform and

equitable valuation of all property, 不要增加税收或者

increase revenue for taxing bodies.

The goal is to be revenue-neutral.

That’s why the assessor gives the taxing bodies the

调整后的里程费率.

Each 董事会 must hold a public hearing before voting to

adopt the millage rate for their district. 这是你的。

opportunity to address these taxing bodies and speak out

for or against the tax increase.

It is possible for taxes to have increased slightly with any

increased 调整后的里程费率, but 如果是征税机构

rolls up their millage rates it will result in higher taxes.

---PG电子试玩网站如何为您服务?

Louisiana Amendment 3 (2023), Property Tax Exemptions for First Responders

This provides an additional property value exemption of $25,000 for first responders including fire fighters, 志愿消防队员, emergency medical service personnel, 紧急响应调度员, 维和警察, 警察和治安官.

To qualify for the exemption you must:

1.) Reside and work in the parish for which you are applying for the exemption

2.) Must provide documentation every year to be eligible for exemption.

A.) Form to be completed by employer.

B.) Employee then has form notarized and turn into the Assessor’s office annually to receive exemption for the current tax year.

C.) Turn form into office in person or by mail (PO 307箱, 利文斯顿拉. 70754)

需要支付物业税?

Click the link below to be redirected to the Sheriff’s website.

办公时间:

Monday -Thursday 7:30am-5:30pm

---PG电子试玩网站: 225-686-7278

邮寄地址:

P.O. 307箱

利文斯顿拉. 70754

Meet Your Assessor: Jeff Taylor

Jeff is a lifelong resident of Livingston parish and has served as Assessor since August 31, 2000. 在他任职期间, he has served residents with honesty and integrity, working to fairly assess property values across the parish and run a customer-focused office. His efforts have been lauded by local media and industry professionals, most recently being recognized as the Assessor of the Year from the Louisiana Assessor’s Association.

你知道吗??

If you are a veteran that has a service related disability and you do not have a copy of your A25 form, you can download the VA app on any smartphone to access your percentage of benefit. If you have still not filed for the new veteran’s exemption, please come by our office with your form or the app to complete the process.

---PG电子试玩网站是来帮忙的!

-

File 宅地豁免 Online

Do you need to file a homestead exemption? Save a trip to our office and click the button below to file online.

-

Need to pay your property taxes?

Do you need to pay your property tax? Click the button below to learn more.

-

评估形式

Looking for tax and assessment forms to download and fill out? Click the button below for a full list.

How are my property taxes calculated?

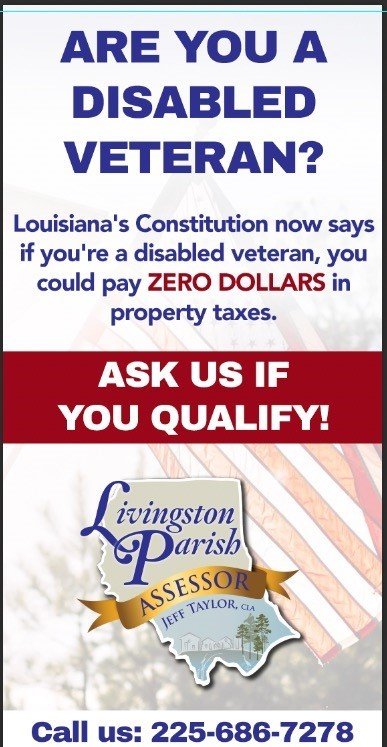

你是伤残退伍军人吗?

1月1日生效, 2023, voters approved a Constitutional Amendment, which replaced and expanded the veteran property tax exemption into 3 categories.

50-69%伤残退伍军人:

宅地豁免 ($75,000) + an additional $25,000 exemption= $PG电子试玩网站,000 total value exemption

70-99%伤残老兵:

宅地豁免 ($75,000) + an additional $45,000 exemption= $120,000 total value exemption

PG电子试玩网站%伤残老兵:

宅地豁免 ($75,000) + remaining assessed value veteran exemption= total value exemption

To ensure you receive the correct veteran exemption, please contact your local Louisiana Department of Veterans Affairs to get an updated Form A25 with your current home address and provide it to our office.

Are you age 65 or permanently disabled?

If you are age 65 or older or have a permanent disability you might be qualified to have your assessed value frozen.

你必须年满65岁.

or

You must be permanently totally disabled as determined by court judgement or as certified by a state or federal agency.

If you meet either of these requirements and have a combined gross household income of $PG电子试玩网站k or less, 你有资格.

This will freeze the assessed value of your property and exclude you from any reassessments, 除非被取消资格. 冻结 不 exempt your property from the increasing or decreasing of millage rates. Millage rates vary from year to year , therefore, the amount due annually could possibly fluctuate.

Please contact our office so we can assist you.

在过去的20年里, 利文斯顿教区评税员 Jeff Taylor has sponsored Assess the Need, a parish-wide school supply drive that helps needy families.

Thanks to the generosity of the people of Livingston Parish, thousands of children have been given supplies to engage in learning, improve their academic outcomes, elevate their self-confidence and expand their opportunities for a bright future. Each success story has made our community a stronger, better place to live.

利文斯顿县 按数字计算(2022年)

房地产包裹: 57,396

商业地块: 1,963

包裹项目总数: PG电子试玩网站

约. PG电子游戏官网 SUBDIVISONS

约. PG电子试玩网站 移动家庭公园

PG电子试玩网站 PERMITS FOR NEW CONSTRUCTION PER WEEK